August 12, 2024

What comes to your mind when someone asks about the industries where fraud is rampant? FinTech or e-commerce may be the ones that pop into your mind. No doubt, these industries are associated with fraud more than any other sector. Surprisingly, healthcare is another industry where fraud is becoming more prevalent every day.

The National Health Care Anti-Fraud Association (NHCAA) reports that healthcare fraud leads to financial losses exceeding $300 billion each year in the United States. It’s important to note that one of the most common types of healthcare fraud is medical billing fraud within healthcare facilities.

These medical billing frauds lead to huge financial losses, compromised patient care, and legal actions. For those interested in learning about the different healthcare frauds, you’re at the right place. Today, we’ll cover the tips to prevent healthcare fraud and the different types of medical billing frauds that healthcare practices commonly deal with.

Grasping the concept of medical billing is essential before understanding medical billing fraud. Medical billing is the process of generating, submitting, and following up on claims with insurance companies to get paid for medical services rendered to patients.

With this respect, medical billing fraud is intentional deception to obtain benefits or payments from insurance providers or government healthcare programs. These frauds are done by healthcare providers, patients, or other stakeholders involved in healthcare.

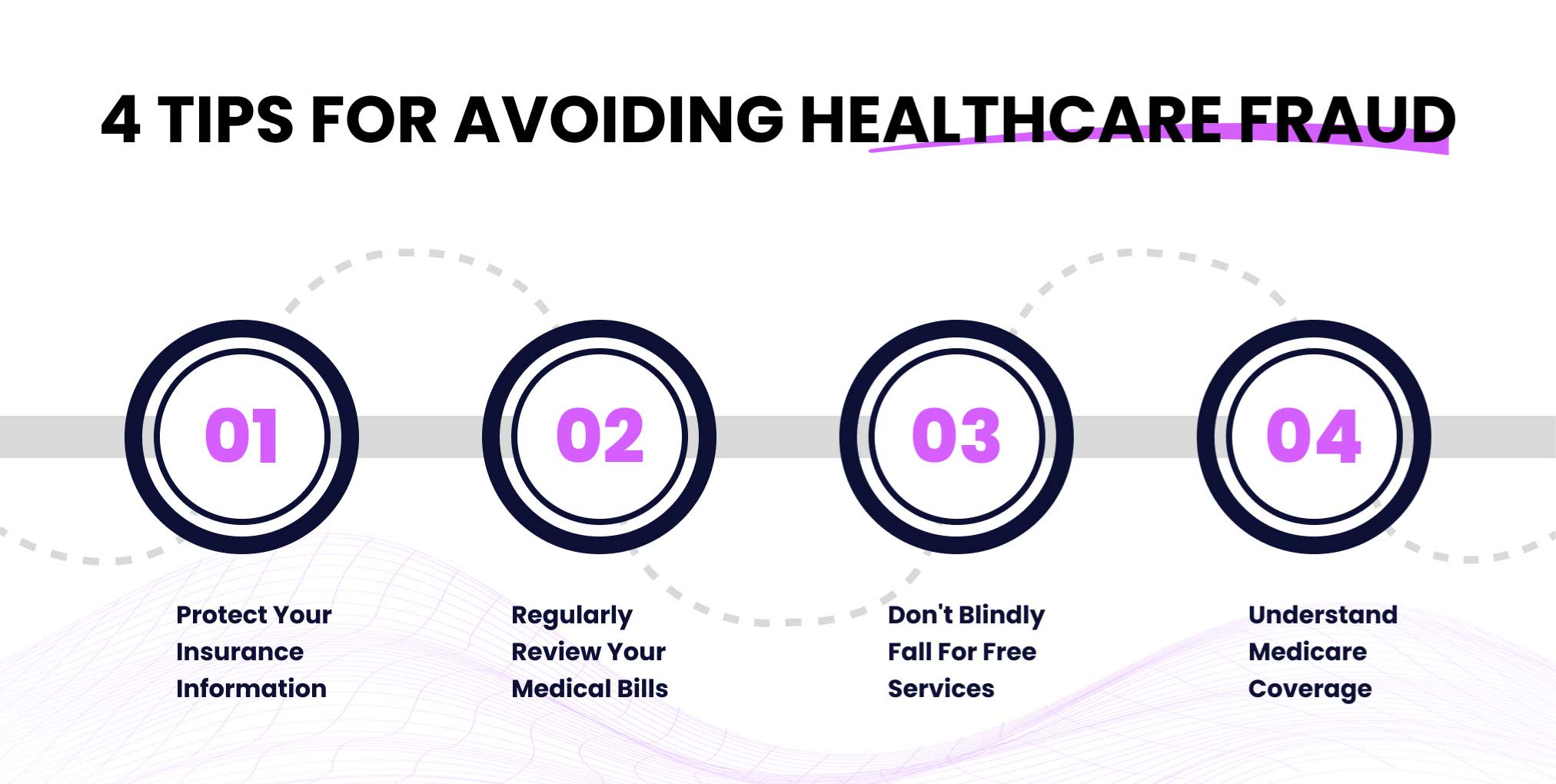

Healthcare fraud is a serious issue that can lead to financial losses, compromised medical records, and even impacts on your health. Healthcare providers can use AI healthcare fraud detection to avoid fraudulent activities. However, you can avoid being a victim of types of medical billing fraud by remaining vigilant and following these necessary tips:

One of the most common mistakes that people make is to share their health insurance information or Medicare card details with others unintentionally. You must treat your health information as you treat your bank information or credit card information. It is advised to only share them with trusted healthcare providers to prevent fraud.

Hundreds of thousands of people won’t even bother checking their bills and statements thoroughly. And it’s another common mistake that leads to fraud and financial losses. If you find any charges for services that you never rendered or duplicate billing, you must contact your provider. You should check the dates, location, and the services you’re billed for to avoid being a victim.

Often, what seems isn’t true. Most “free” services are fraud, and you must remain cautious if a free service asks for your insurance information. A deep understanding of these things will help you know that these free offers are not actually free and could result in charges to your insurance. Scammers use this tactic to access your insurance details and submit fraudulent claims. We recommend you not fall for such offers and always verify the legitimacy of such offers.

If you have thorough information about anything, there are fewer chances that anybody can fool you. Right? The same goes for your insurance plan. If you know what your Medicare plan covers, then you will not fall for scams. It is recommended that you familiarize yourself with the specific services and procedures included in your coverage to easily spot any fraudulent charges or false claims of necessary additional policies or services.

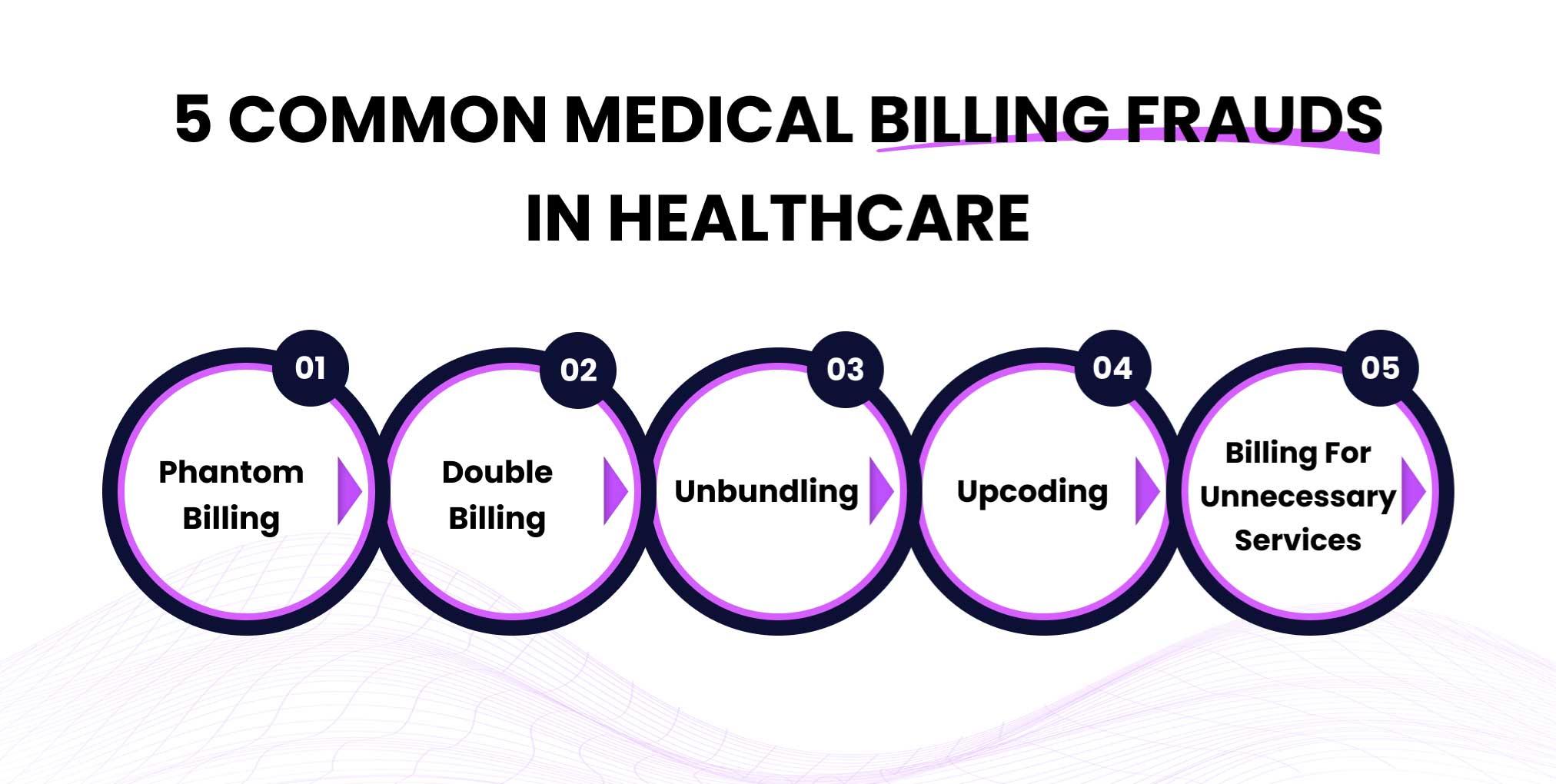

To avoid healthcare medical billing fraud, it is crucial to understand the types of fraud happening in the sector. Here are 5 most common types of billing fraud in healthcare with real-world examples:

Phantom billing is a type of fraud in which a patient is charged for services or treatments that were never provided to him in the first place. Healthcare providers submit claims to insurance companies to get paid back for non-existing services.

Let’s take an example to clarify the concept of phantom billing: Imagine you went to a dental clinic for teeth cleaning and filling. However, you find yourself charged for root canal therapy as well, which you never received.

In Feb 2023, 23 people from Michigan were charged for defrauding Medicare of over $61.5 million by submitting claims for services that were never provided.

Double billing is a scheme in which a patient is billed multiple times for the same service or treatment. Fraudsters often manipulate details such as dates, times, and descriptions to make the billing appear separate.

For Example, you went to the dermatologist for a routine skin check-up. However, when you receive the bill, you learn that you are billed twice for the same appointment but with different dates.

In December 2023, United Memorial Medical Center was charged with double billing for COVID-19 tests. They were required to pay $2 million and make additional contingent payments to resolve the alleged False Claims Act violations.

Unbundling in healthcare refers to a fraudulent scheme in which the services are billed separately when they should be billed in a single code. It can be due to negligence or intentionality. This is done because separately reimbursing each code creates a total higher than the comprehensive code.

Suppose your doctor asks you to get a set of lab tests that should be billed under one code. Instead, the lab charges you for each test individually. It comes under the act of unbundling medical billing fraud.

In March 2014, Duke University agreed to pay $1,000,000 to settle a False Claims Act case with the US Department of Justice. Duke was accused of unbundling cardiac and anesthesia services by improperly using the modifier “59” to separate services that should have been billed together.

Upcoding is a scheme in which the healthcare provider submits a claim to the insurance company for a more severe, complex, or expensive service than the service actually offered to generate more money.

Suppose you went to a doctor for a regular check-up. You have a mild fever that can be cured with a low-dose medication and adopting a healthier lifestyle. Instead, the doctor claims you have a severe condition requiring extensive treatment and medication. You get billed for the medications you don’t need just because the doctors want higher reimbursements.

Dr Valdes, who lives in Miami, received 60 months imprisonment in federal prison as a medical fraud punishment. He submitted approximately $38 million in fraudulent claims for expensive Infliximab infusions that patients never received.

As the name suggests, it is a fraudulent medical billing scheme in which patients are billed for unnecessary services or items. It can include unnecessary tests, treatments, etc, to increase the organizational revenue.

Suppose a patient visits a clinic for a routine check-up. The doctor demands a series of expensive and unnecessary medical diagnostic tests, including CT scans.

In 2015, Detroit-area neurosurgeon Aria O. Sabit was found guilty in two criminal cases of performing unnecessary surgeries. His fraudulent activities resulted in over $11 million in false claims.

Medical billing frauds are more prevalent than ever in the healthcare industry. To combat this, healthcare providers can entrust their medical billing tasks to a reliable medical billing services provider to ensure compliance, faster reimbursements, and avoid any errors and fraud. While providers have their role to play, we must avoid being victims of healthcare fraud by understanding the different types of medical billing fraud and following the above-mentioned tips.

Xeven Solutions is a leading provider of medical billing services. We have helped numerous healthcare providers to automate their medical billing and coding tasks and remove the burden from their teams. We have medical billing experts who are proficient in medical coding and eliminate the chances of upcoding or unbundling. Our well-versed medical billers offer HIPAA-compliant services and prioritize your data protection while expediting the payment collection process.